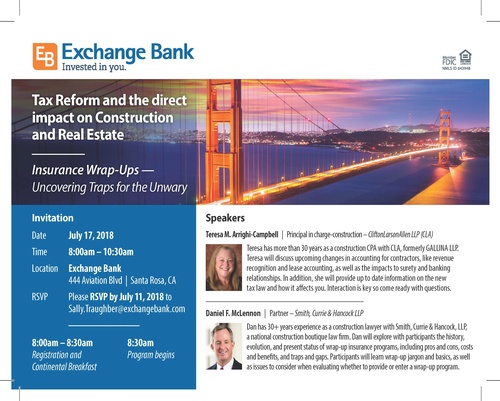

Free Seminar on Tax Reform and Insurance Wrap-Ups Hosted by Exchange Bank

Tax Reform and the direct impact to Construction and Real Estate

Insurance Wrap-Ups — Uncovering Traps for the Unwary

Speakers

Teresa M. Arrighi-Campbell | Principal in charge-construction – CliftonLarsonAllen LLP (CLA)

Teresa has more than 30 years as a construction CPA with CLA, formerly GALLINA LLP. Teresa will discuss upcoming changes in accounting for contractors like revenue recognition and lease accounting as well as the impacts to surety and banking

relationships as well provide up to date information on the new tax law and how it affects you. Interaction is key so come ready with questions.

Daniel F. McLennon | Partner – Smith, Currie & Hancock LLP

Dan has 30+ years as a construction lawyer with Smith, Currie & Hancock, LLP, a national construction boutique law firm. Dan will explore with participants the history, evolution, and present status of wrap-up insurance programs, including pros and cons, costs and

benefits, and traps and gaps. Participants will learn wrap-up jargon and basics, as well as issues to consider when evaluating whether to provide or enter a wrap-up program.

Click here for flyer

Date and Time

Tuesday Jul 17, 2018

8:00 AM - 10:30 AM PDT

July 17, 2018 / 8:00am to 10:30am

8:00 am - 8:30 am

Registration and Continental Breakfast

8:30am

Program Begins

Location

Exchange Bank

444 Aviation Blvd, Santa Rosa

Fees/Admission

FREE - hosted by Exchange Bank

Please RSVP by July 11, 2018

Website

Contact Information

Alan Aranha, 415 720 3510

Send Email